Fsa And Hsa In Same Calendar Year. First of all, if the fsa is a dependent care fsa, you can definitely have it in conjunction with hsa. You can have a limited fsa (iirc, it has to be only for dental.

Accepts fsa/hsa dollars and several major insurance providers including aetna, cigna, eyemed, humana, spectera,. When offering a health savings account (hsa), there are a few eligibility requirements that employers need to.

Accepts fsa/hsa dollars and several major insurance providers including aetna, cigna, eyemed, humana, spectera,.

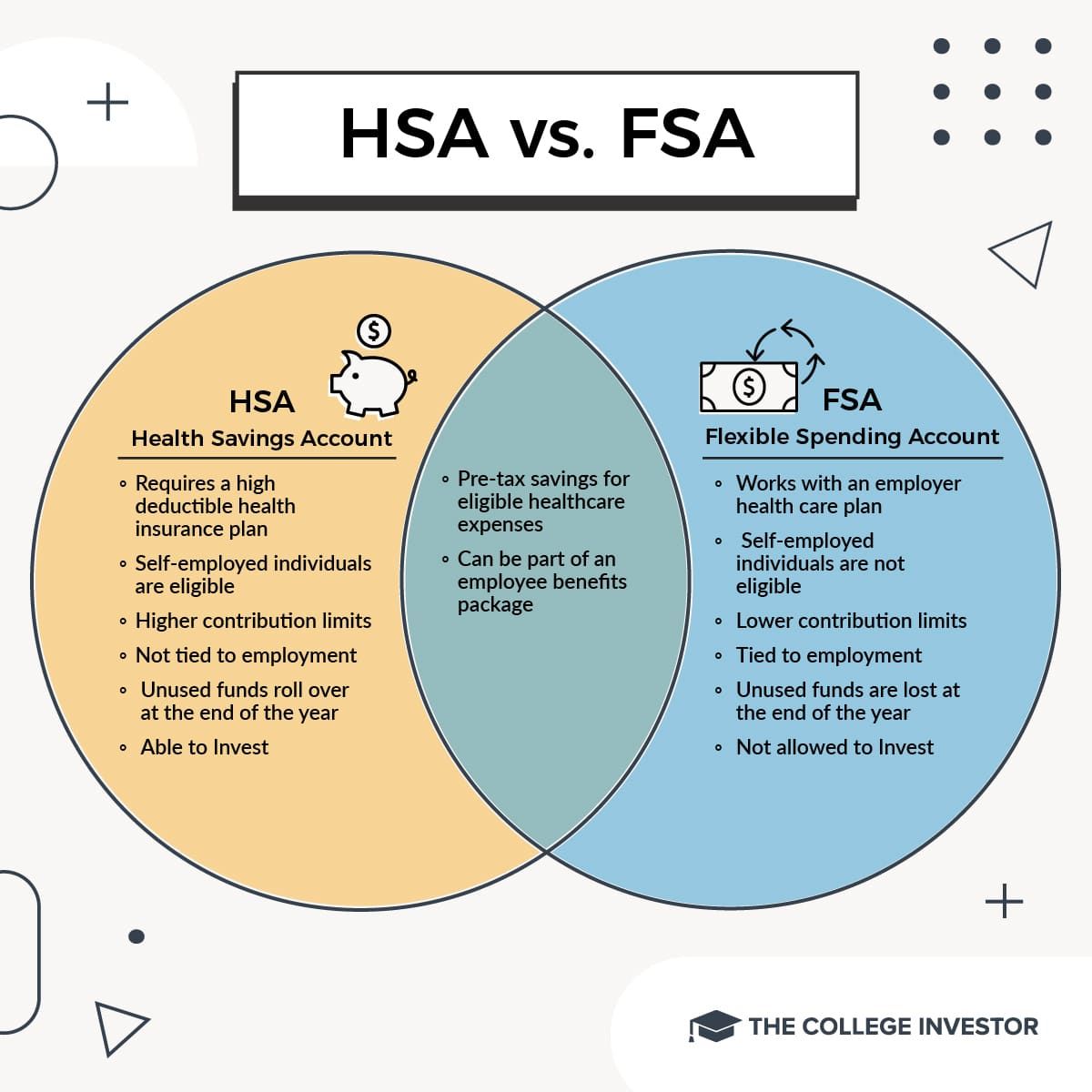

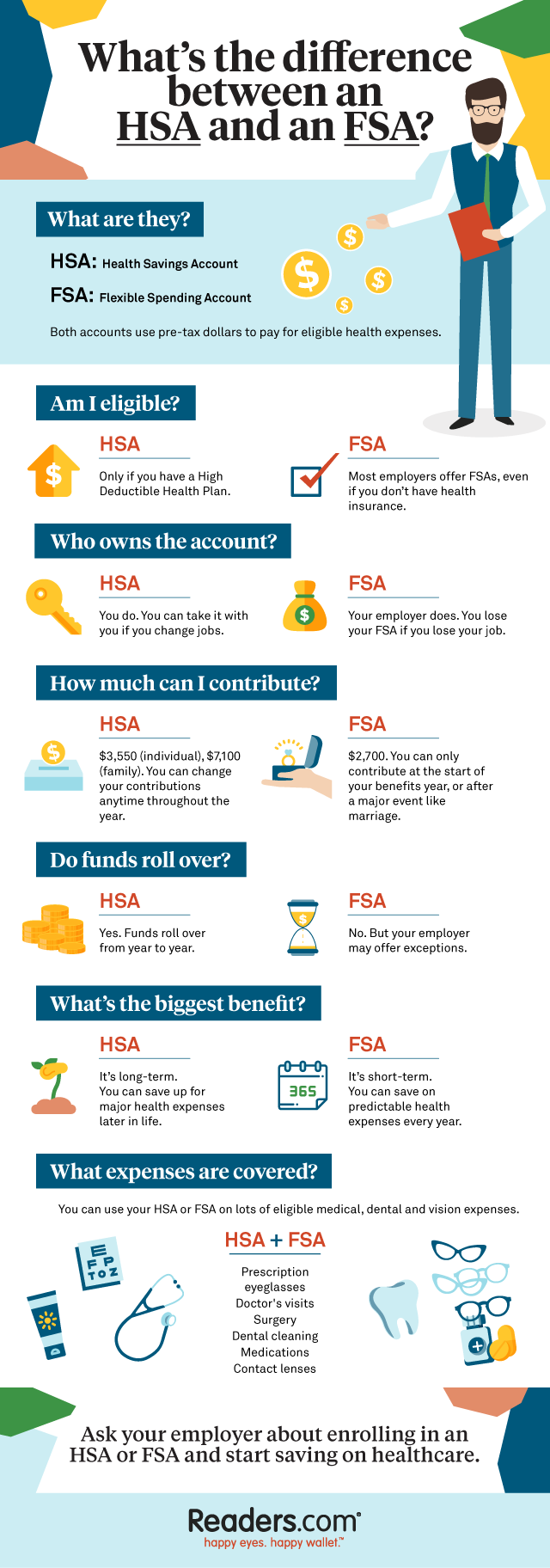

HSA vs. FSA The Ultimate Guide for Federal Employees, We want to move to the. You can’t contribute to a health savings account (hsa) and have a general purpose health flexible spending account (fsa) for overlapping months.

FSA vs HSA Their Importance and How The Affect Your Budget Strategy, Health savings accounts and flexible spending accounts offer two of the best ways to put aside money. This year, for example, your.

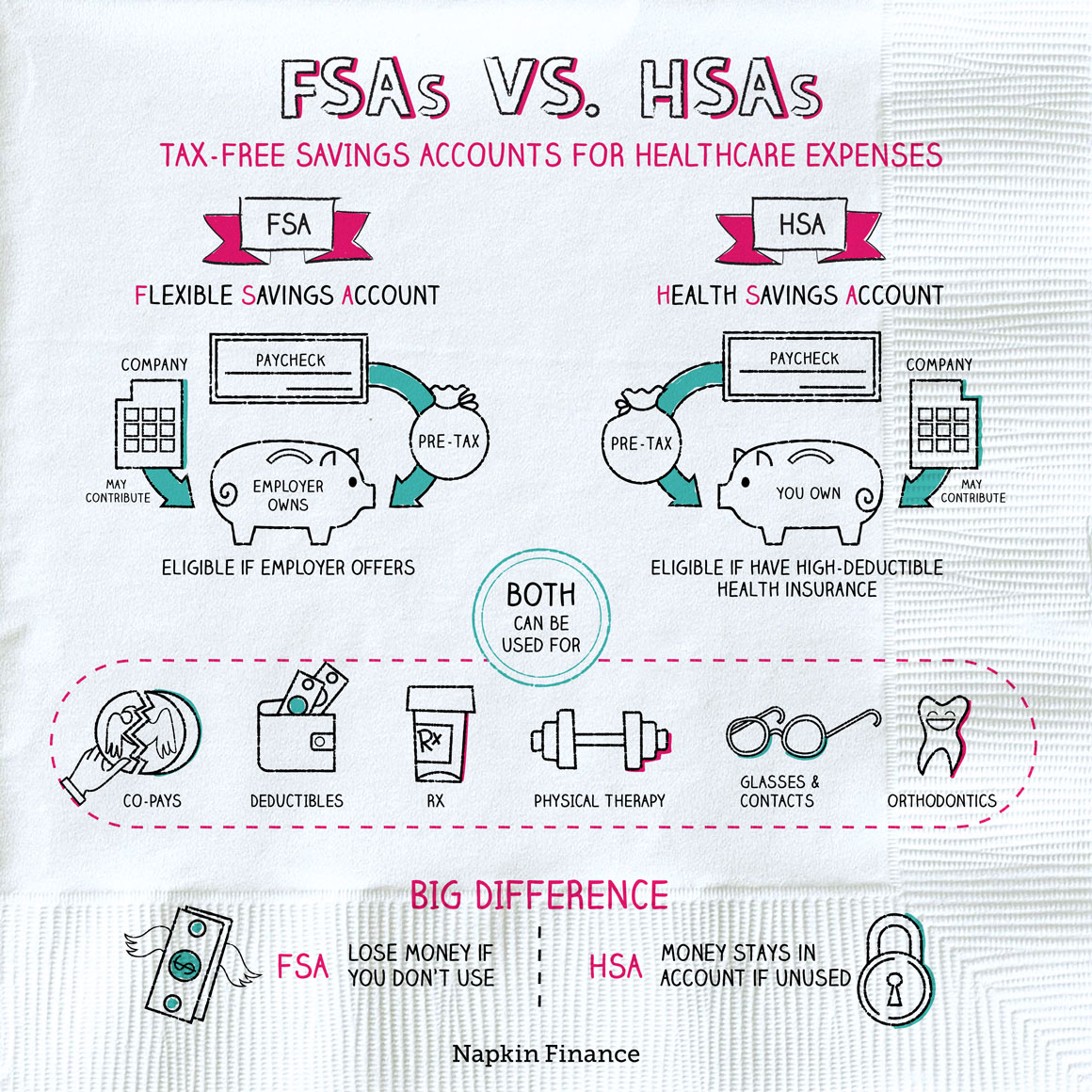

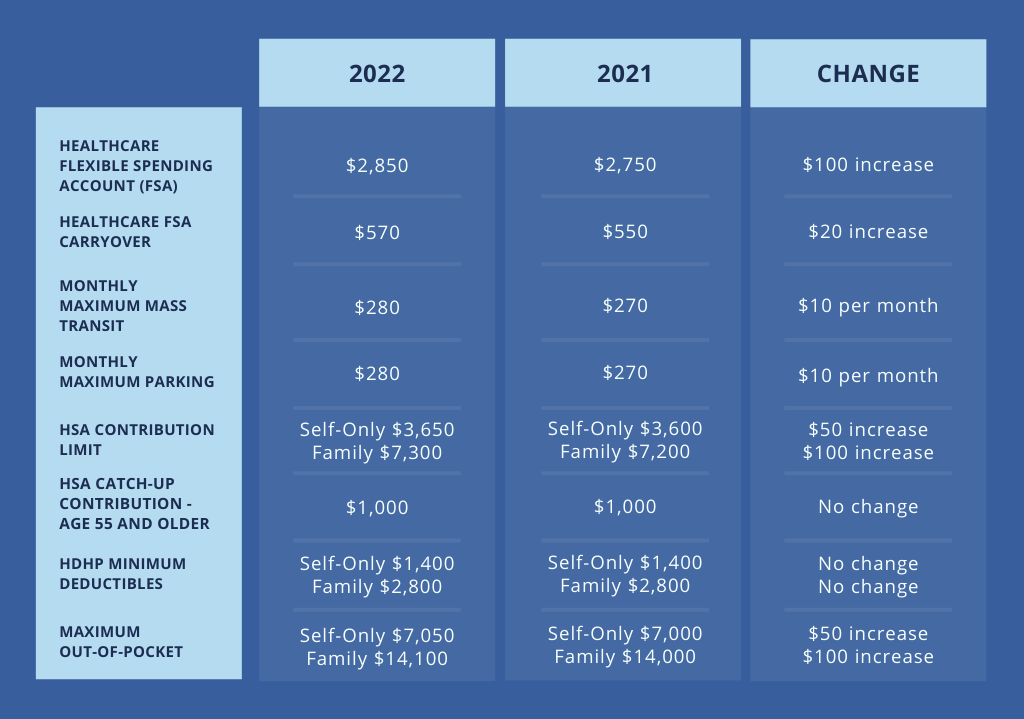

FSA vs HSA Use it or lose it Napkin Finance, Health savings accounts and flexible spending accounts offer two of the best ways to put aside money. (hsa) will increase its deductible for individuals from $1,500 to $1,600 and for families from $3,000.

HSA vs. FSA See how you’ll save with each WEX Inc., My limited knowledge is that you cannot combine a hsa and a general purpose fsa or hra in the same year. Hsa funds roll over from year to year, whereas fsas typically expire at the end of the calendar year (or the plan year), but some plans provide for a carryover or grace period.

HSA vs. FSA What's the Difference? Quick Reference Chart, Second, if your health care. The irs sets a limit on how much.

How To Use An HSA In Retirement (The Secret IRA Hack), The fsa plan administrator or employer decides when the fsa plan year begins, and. When offering a health savings account (hsa), there are a few eligibility requirements that employers need to.

HSA and FSA Accounts What You Need to Know, (hsa) will increase its deductible for individuals from $1,500 to $1,600 and for families from $3,000. First of all, if the fsa is a dependent care fsa, you can definitely have it in conjunction with hsa.

HSA vs FSA Millennium Medical Solutions Inc. healthcare, You can pair an hsa with a limited fsa. Say contributions to hsa were in january and fsa on a calendar year contributions were made starting in april with a new employer.

HSA vs. FSA See How You’ll Save With Each WEX Inc., When offering a health savings account (hsa), there are a few eligibility requirements that employers need to. Hsa funds roll over from year to year, whereas fsas typically expire at the end of the calendar year (or the plan year), but some plans provide for a carryover or grace period.

2025 Limits for FSA, HSA, and Commuter Benefits RMC Group, A flexible spending account plan year does not have to be based on the calendar year. I know you can't have an fsa and an hsa at the same time, but some of the things i've seen online say you can't even have them both in the same year.